價值求知

google analytics

1/21/2026

短評台積電FY25業績

1/02/2026

2025年結--贏家的詛咒

| Stock | portfolio % |

| VOO | 17.82% |

| NVDA | 15.59% |

| MSFT | 12.13% |

| TSM | 12.70% |

| US-T GOVT Note 4.25 31Dec'25 | 8.36% |

| US-T GOVT Note 0.375 31Jan'26 | 8.25% |

| AAPL | 6.82% |

| AMD | 6.71% |

| AMZN | 3.86% |

| NTDOY | 2.47% |

| DDOG | 2.27% |

| TSLA | 1.13% |

| 900 | 1.55% |

| 1830 | 0.33% |

12/23/2025

對人工智慧的一些思考

I can make the argument that if you're a model company, you may have a winner's curse. You may have done all the hard work, done unbelievable innovation, except it's one copy away from that being commoditized.

8/28/2025

點評Nvidia FY26Q2業績

Jensen, I wanted to ask you about your $3 trillion to $4 trillion in data center infrastructure spend by the end of the decade. Previously, you talked about something in the $1billiontrillion range, which I believe was just for compute by 2028. If you take past comments, $3 trillion to $4 trillion would imply maybe $2billiontrillion plus in compute spend. And just wanted to know if that was right and that's what you're seeing by the end of the decade. And wondering what you think your share will be of that. Your share right now of total

CEO黃仁勳回答:

Thanks. As you know, the CapEx of just the top 4 hyperscalers has doubled in 2 years. As the AI revolution went into full steam, as the AI race is now on, the CapEx spend has doubled to $600 billion per year. There's 5 years between now and the end of the decade, and $600 billion only represents the top 4 hyperscalers. We still have the rest of the enterprise companies building on-prem. You have cloud service providers building around the world. United States represents about 60% of the world's compute. And over time, you would think that artificial intelligence would reflect GDP scale and growth and so -- and would be, of course, accelerating GDP growth.

And so our contribution to that is a large part of the AI infrastructure. Out of a gigawatt AI factory, which can go anywhere from $50 billion to plus or minus 10%, let's say, $50 billion to $60 billion, we represent about $35 billion plus or minus of that and $35 billion out of $50 billion per gigawatt data center.

7/17/2025

台積電FY25Q2業績短評

留意以平台劃分的收入分類,

For the five-year period starting from 2024, we expect our long-term revenue growth to approach a 20% CAGR in US dollar term, fueled by all four of our growth platforms, which are smartphone, HPC, IoT and automotive.

7/01/2025

2025半年結

| Stock | portfolio % |

| VOO | 17.29% |

| NVDA | 14.80% |

| MSFT | 13.96% |

| TSM | 10.72% |

| US-T GOVT Note 4.25 31Dec'25 | 9.38% |

| US-T GOVT Note 2.75 31Aug'25 | 9.34% |

| AAPL | 5.66% |

| AMD | 5.06% |

| AMZN | 4.19% |

| NTDOY | 3.88% |

| DDOG | 2.48% |

| TSLA | 0.91% |

| 900 | 1.78% |

| 1830 | 0.53% |

VOO(+)

6/10/2025

近況更新與近來操作的反思

| Stock | portfolio |

| VOO | 16.84% |

| NVDA | 14.53% |

| MSFT | 14.45% |

| TSM | 10.54% |

| US-T Note 4.25 31Dec'25 | 10.19% |

| US-T Note 2.75 31Aug'25 | 10.13% |

| AAPL | 6.16% |

| AMZN | 4.42% |

| NTDOY | 3.73% |

| AMD | 3.10% |

| DDOG | 2.47% |

| TSLA | 0.94% |

| 1830 | 0.77% |

| 0900 | 1.73% |

4/07/2025

新關稅下減持倉位的理由

不計債券(25%),股票持倉已降至約50%=(1-34%)*(1-25%)

3/05/2025

談Nvidia FY25業績與近期的暴跌

2/12/2025

webb site的關閉

2/04/2025

台積電FY24全年業績快評

根據展望, Q1的業績相當於按年增長超過30%

For the five-year period starting from 2024, we expect our long-term revenue growth to approach a 20% CAGR in US dollar term, fueled by all four of our growth platforms, which are smartphone, HPC, IoT and automotive.

1/02/2025

2024年結---AI狂潮的全面爆發

| Stock | portfolio % |

| NVDA | 16.7 |

| TSM | 13.1 |

| VOO | 12.29 |

| MSFT | 10.48 |

| AAPL | 10.38 |

| US-T GOVT Note 4.25 31 Dec'25 | 8.28 |

| US-T GOVT Note 2.75 31 Aug'25 | 8.18 |

| AMD | 5.01 |

| ADBE | 4.61 |

| AMZN | 3.64 |

| DDOG | 2.37 |

| NTDOY | 2.12 |

| 0900 | 1.24 |

| TSLA | 1 |

| 1830 | 0.59 |

Rule number one: never lose money. Rule number two: Never forget rule number one.

相當於只有9%的增長

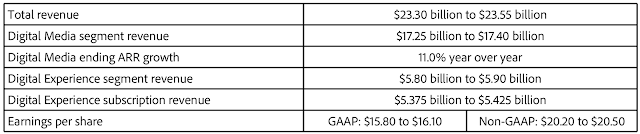

But apologies to state the obvious, but investors aren't, you know, that excited or are showing that excitement. The stock is a major under-performer on a year-to-date date. It's down again on an after-hours basis today. And I would point to it's the lack of acceleration that we're seeing in the numbers, right? Digital Media net new ARR this quarter grew just -- or in Creative Cloud grew 2%.

You're guiding to decelerating growth into the forward year despite all this innovation. And I think the question that it brings up in investors' mind is, is there some leak in the bucket, right? All this innovation, new monetization avenues, pricing going up, but the growth is going in the wrong direction. Like is there a part of the equation that's not working? Is there share losses? Is there something that we're not seeing that is taking away that momentum in the numbers that's not -- sort of not in the acceleration in the numbers, if you will?